What Does Tax Avoidance Meaning Mean?

Wiki Article

All about Tax Avoidance And Tax Evasion

Table of ContentsThe 7-Minute Rule for Tax Amnesty MeaningThe Single Strategy To Use For Tax Avoidance And Tax EvasionThe Basic Principles Of Tax Amnesty Unknown Facts About Tax AccountingTax Avoidance And Tax Evasion for Beginners

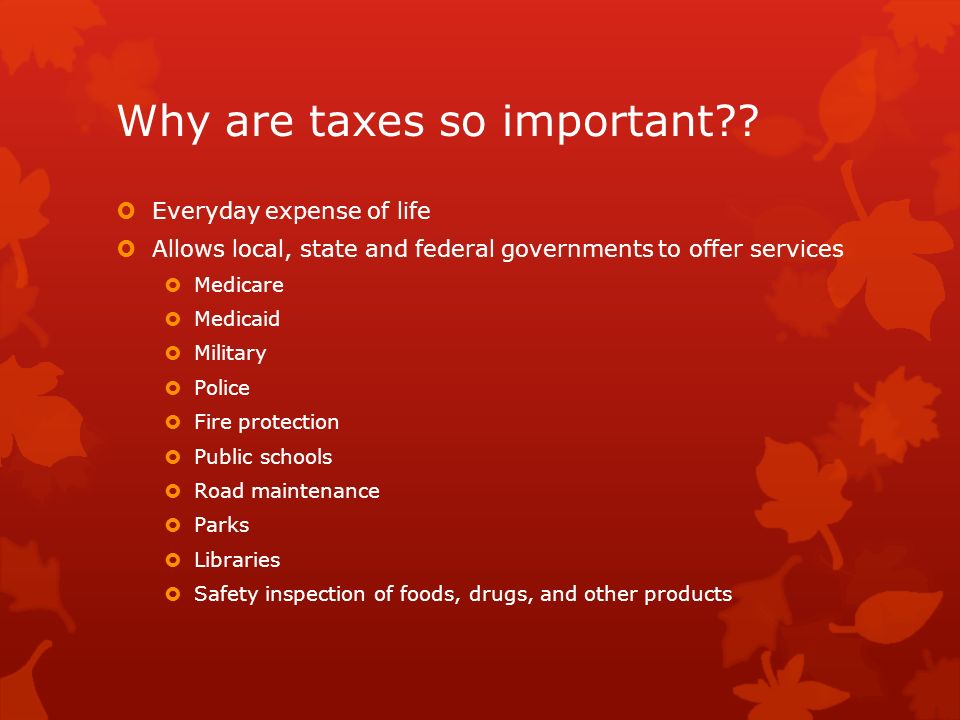

Federal governments impose costs on their citizens and organizations as a way of increasing income, which is then used to meet their financial needs. This consists of funding federal government and also public tasks along with making the organization atmosphere in the nation conducive for financial growth. Without taxes, governments would certainly be unable to meet the needs of their societies.

Administration is a vital part in the smooth operating of country events. Poor administration would have far reaching ramifications on the entire nation with a hefty toll on its economic growth. Good governance guarantees that the cash accumulated is made use of in a fashion that advantages citizens of the country. This money additionally mosts likely to pay public servants, cops officers, members of parliaments, the postal system, and also others.

Besides social jobs, federal governments also use cash gathered from taxes to money fields that are critical for the well-being of their citizens such as safety, clinical research study, environmental management, etc. Several of the cash is likewise channeled to money tasks such as pension plans, welfare, childcare, and so on. Without tax obligations it would be difficult for governments to raise money to money these kinds of tasks.

Not known Facts About Tax

For organization to prosper in the nation, there has to be excellent framework such as roads, telephones, electrical power, and so on. This facilities is developed by governments or through close participation of the government. When federal governments collect money from taxes, it ploughs this money into advancement of this infrastructure and also consequently advertises economic task throughout the country.Tax obligations aid elevate the criterion of living in a country. Services flourish when there is a market for their item as well as services.

This is why it is necessary that citizens strive to pay tax obligations as well as comprehend that it is meant to be greater than just a "money grab" from the federal government. Certified Public Accountant Business Consulting Structure Your Economic Success Significance of Keeping Track of Your Expenditures.

Tax Amnesty for Dummies

Note: the connections are substantial at the 1% degree and stay substantial when controlling for revenue per head. The quantity of the tax obligation expense for companies matters for financial investment and also growth. Where tax obligations are high, companies are extra likely to decide out of the formal sector. A study shows that greater tax rates are linked with less formal companies and also reduced private investment.Maintaining tax rates at an affordable level can motivate the growth of the exclusive industry and also the formalization of businesses. Enforcing high tax obligation costs on organizations of this size may not add much to federal government tax profits, but it might trigger organizations to move to the informal market or, also worse, cease operations.

The program reduced general tax costs by 8% and also added to a rise of 11. 6% in business licensing rate, a 6. 3% rise in the enrollment of microenterprises and also a 7. 2% rise in the variety of companies signed up with the tax obligation authority. Earnings collections rose by 7.

Financial advancement frequently enhances the need for brand-new tax obligation income to fund climbing public expense. At the very same, time it requires an economic climate to be able to fulfill those requirements. Much more crucial than the level of taxation, nonetheless, is exactly how income is used. In creating economic situations high tax obligation rates and also weak tax administration are not the only factors for other reduced prices of taxation.

What Does Tax Amnesty 2021 Do?

In Qatar and also Saudi Arabia, it would certainly need to make 4 settlements, still among the most affordable on the planet. In Estonia, abiding by earnings tax obligation, value included tax obligation (BARREL) and Related Site labor tax obligations and also payments takes only 50 hrs a year, around 6 working days. Study locates that it takes an Operating study firm much longer generally to follow barrel than to abide by corporate revenue tax obligation.Study shows that this is explained by variations in management methods as well as in how barrel is applied. Conformity has a tendency to take less time in economic situations where the very same tax authority carries out VAT and business earnings tax obligation. Using online filing and also settlement additionally significantly reduces conformity time. Frequency and also length of VAT returns also matter; requirements to send invoices or various other paperwork with the returns include in conformity time.

Frequently, the experience of taxation begins after the tax return has actually been filed. Postfiling processessuch as claiming a barrel refund, undertaking a tax obligation audit or appealing a tax obligation assessmentcan be one of the most tough communication that a company has with a tax obligation authority. Businesses might need to invest even more time and also initiative into the processes occurring after declaring of tax obligation returns than into the routine tax obligation compliance treatments.

In concept, barrel's legal incidence is on the final consumer, not on services. According to tax obligation plan guidelines established out by the Organisation for Economic Co-operation as well as Advancement (OECD), a VAT system should be neutral as well as reliable. redirected here The lack of a reliable barrel reimbursement system for organizations with an excess input VAT in an offered tax duration will certainly undermine this goal.

Tax Amnesty Fundamentals Explained

Hold-ups as well as inefficiencies in the barrel reimbursement systems are frequently the result of anxieties that the system could be mistreated and also vulnerable to fraudulence.18 Moved by this worry, many economic climates have actually established procedures to modest and also limit the option to the VAT reimbursement system and also subject the refund claims to detailed step-by-step checks.The Operating situation research study firm, Taxpayer, Co., is a domestic service that does not trade globally. It executes a general commercial and industrial activity and also it is in its 2nd year of operation. Taxpayer, Co. fulfills the barrel threshold for registration and its monthly sales as well as regular monthly operating budget are dealt with throughout the year, causing a favorable output barrel payable within each accounting period.

Report this wiki page